What is Trading Forex?

Abstract: Forex trading is the buying and selling of currencies on the foreign exchange market, a global platform that operates 24/7 without a centralized exchange. It's a dynamic world that offers opportunities to trade in emerging global markets.

Online Trading and Investing

Online trading has made it easier and faster to trade financial instruments like forex. Platforms provided by brokers allow individuals to manage their portfolios efficiently.

Key Points:

- Online trading is accessible and fast.

- Reliable platforms are crucial for forex trading.

- Platforms should offer user-friendly interfaces and robust security.

Trading Accounts

Trading accounts are offered by brokers and are essential for investing in financial markets. They provide access to tools and resources to guide trading decisions.

Key Considerations:

- Choose a broker with regulatory compliance and a wide range of services.

- Look for platforms with competitive spreads and forex-specific tools.

- Be aware of fees to maximize profits.

Forex Trading Platforms

A good forex trading platform is user-centered and offers a range of features to meet different trading needs.

Notable Platforms:

- Forex.com for user-friendly design.

- Plus500 for a streamlined interface.

- OANDA and IG for advanced analytical tools.

- MetaTrader 4 and 5 for charting and automated trading.

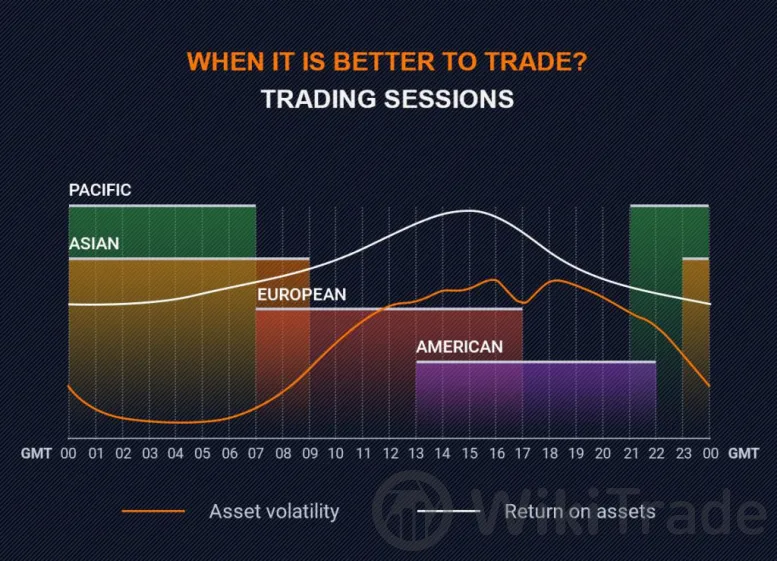

Identifying Forex Trading Sessions

Understanding the different trading sessions (Sydney, Tokyo, London, and New York) is crucial as they offer varying levels of market liquidity and potential for profit.

London Session:

- Begins at 8:00 GMT, ends at 16:00 GMT.

- High market volatility due to economic news releases.

How Can I Trade Forex?

Learning forex trading involves understanding the basics, finding reputable educational resources, and using demo accounts for practice.

Steps to Learn Forex:

- Understand trading jargon and global economies.

- Use educational resources like BabyPips, Forex.com, and Investopedia.

- Practice with demo accounts before trading with real money.

- High volatility.

- Use of leverage.

- Potential for significant losses.

- USD/CAD is influenced by oil prices.

- Interest rate changes by the U.S. Federal Reserve affect USD pairs.

- Economic calendars.

- Interest rate decisions.

- Employment reports.

- Policy statements.

A Deep Dive into Forex

Forex is the world's largest financial market with daily trading volumes exceeding $6.6 trillion. It offers high liquidity and potential for profit but also comes with risks.

Risks:

Understanding International Forex

International forex trading involves understanding the unique characteristics of different currencies and how they are influenced by economic indicators and geopolitical events.

Currency Pairs:

Forex News and Resources

Staying informed with forex news is critical for making timely and informed trading decisions.

Tools to Stay Informed:

Conclusion

Forex trading presents an intriguing opportunity for profit but requires thorough understanding and strategic planning. By leveraging essential knowledge, strategic planning, and valuable resources, you can navigate the forex market successfully.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade