HYCM Forex Broker Review

Abstract: HYCM (Henyep Capital Markets) is a well-known broker in the financial markets, offering trading services in various instruments, including forex, commodities, indices, cryptocurrencies, and stocks. They are known for their long history in the industry, having been founded in 1977, and for being regulated by multiple authorities, including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Cayman Islands Monetary Authority (CIMA), and the Dubai Financial Services Authority (DFSA) . HYCM also provides a range of trading accounts, platforms, and educational resources for traders. You can visit their official website: https://hycm.com/en to learn more about it.

HYCM (Henyep Capital Markets) is a well-known broker in the financial markets, offering trading services in various instruments, including forex, commodities, indices, cryptocurrencies, and stocks. They are known for their long history in the industry, having been founded in 1977, and for being regulated by multiple authorities, including the UKs Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Cayman Islands Monetary Authority (CIMA), and the Dubai Financial Services Authority (DFSA) . HYCM also provides a range of trading accounts, platforms, and educational resources for traders. You can visit their official website: https://hycm.com/en to learn more about it.

| HYCM Review Summary | |

| Broker Name | HYCM |

| Full Name | Henyep Capital Markets |

| Founded | 1977 |

| Registered Country/Region | St Vincent and the Grenadines |

| Regulation | FCA, CySEC, CIMA, and DFSA |

| Market Instruments | Forex, CFD Stocks, Indices, Cryptos, and Commodities |

| Demo Account | Availiable |

| Leverage | Up to 1:500 |

| Spread | From 1.5 pips (Fixed Account) |

| Minimum Deposit | $20 |

| Trading Platforms | MT4, MT5, HYCM Trader |

| Trading Tools | Calculators, Economic Calendar, Trading Central, Seasonax, and Financial Source |

| Payment Methods | Bank Wire, Visa and MasterCard, Neteller, Skrill, Crypto, PerfectMoney, AstroPay, WebMoney, PayTrust, Fasapay, Zotapay, and UPI |

| Base Currencies | EUR, USD, GBP, AED, JPY |

| Inactivity Fee | $10 each month after 90 days of inactivity |

| Negative Balance Protection | Yes |

| Regional Restrictions | Unavailable to residents of certain jurisdictions such as Afghanistan, Belgium, Hong Kong, the United States of America and some other regions |

| Customer Support | Tel: +442088167812 |

| Email: support@hycm.com, accounts@hycm.com, info@hycm.com, complaints@hycm.com | |

| Live Chat | |

| Telegram, Facebook, Twitter, Linkedin, Instagram, YouTube, Crunchbase, and Discord | |

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Pros

Experience and Reliability: Founded in 1977, HYCM is a trusted broker with a long history in the financial markets.

Diverse Trading Instruments: HYCM offers diverse trading instruments, including forex, stocks, indices, cryptos, commodities, and CFDs, providing traders with a wide range of options.

Multilingual Support: The official website and customer support are available in 14 languages, making it accessible to traders from various regions.

Protection Against Negative Balance: Ensures traders never owe more than the funds they invested, minimizing potential losses due to unforeseen market movements.

Educational Resources: HYCM provides a variety of educational materials to help traders learn more about forex, stocks, indices, and commodities trading.

Cons

Limited Customer Support Hours: Customer service is not available on weekends, which is inconvenient for some traders.

Regional Restrictions: HYCM is unavailable to residents of certain jurisdictions, including Afghanistan, Belgium, Hong Kong, the United States of America, and some other regions.

Inactivity Fee: HYCM charges $10 each month after 90 days of inactivity, which is a concern for traders who do not trade frequently.

Security

HYCM prioritizes your security through multiple regulatory licenses, robust data encryption, and account protection measures like negative balance protection.

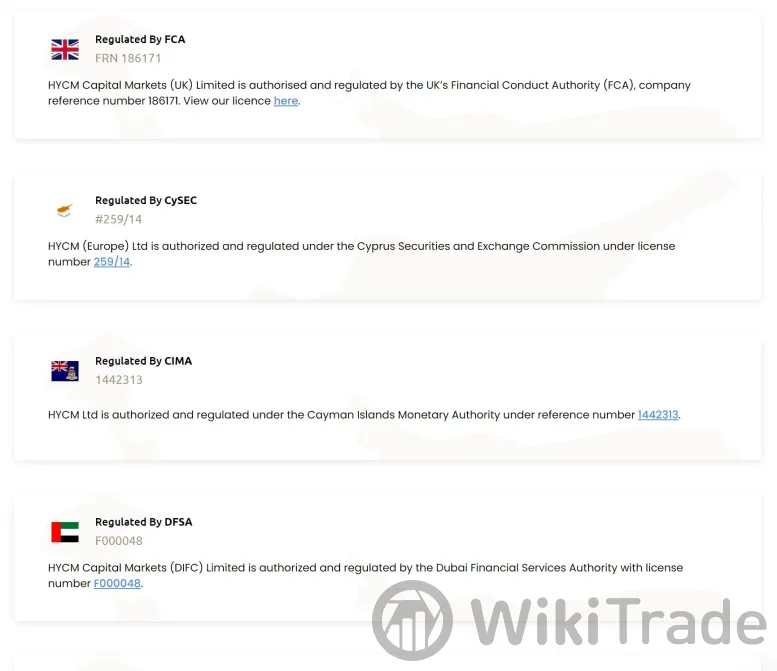

Regulation: HYCM is regulated by multiple reputable authorities, including the UK Financial Conduct Authority (FCA, 186171), the Cyprus Securities and Exchange Commission (CySEC, 259/14), the Dubai Financial Services Authority (DFSA, F000048) and the Cayman Islands Monetary Authority (CIMA, 1442313). This multi-regulated status ensures that the broker operates in accordance with strict regulatory standards.

Encryption: HYCM uses advanced encryption protocols to secure all data communication between the trading client and its servers. This includes the use of dynamically generated 128-bit keys, which are the standard for banking operations, ensuring that all transactions and sensitive information are protected from unauthorized access.

Data Protection: Personal and account information on the HYCM website are encrypted using VeriSign issued 128-bit SSL certificates, further enhancing data protection and ensuring that client information remains confidential.

Negative Balance Protection: HYCM offers Negative Balance Protection to its clients as part of its Client Agreement, ensuring that clients cannot lose more than their overall account balance, even in volatile market conditions.

Market Instruments

HYCM offers diverse market instruments to clients, including forex, CFD stocks, indices, cryptocurrencies, and commodities.

Forex: HYCM provides access to the foreign exchange market, allowing traders to trade major, minor, and exotic currency pairs. This market is known for its high liquidity and volatility, offering opportunities for profit through currency price movements. HYCM supports more than 65 forex pairs, including AUDCAD, AUDCHF, EURAUD, GBPDKK, NEDSGD, and so on.

CFD Stocks: Clients can trade CFDs on a wide range of stocks, including 3M Company, AIG, AT&T, Activision, and so on, allowing them to speculate on the price movements of individual companies without owning the underlying shares. This provides traders with the opportunity to profit from both rising and falling stock prices.

Indices: HYCM offers trading on stock indices, including AUS200, EUR50, FRA40, GER40 and so on, which are measures of the performance of a group of stocks from a particular exchange. Trading indices allows traders to speculate on the overall performance of a market or sector, rather than individual stocks.

Cryptocurrencies: HYCM offers trading in popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin and so on. Trading cryptocurrencies allows clients to take advantage of the volatility in the cryptocurrency market and profit from price movements.

Commodities: Clients can trade CFDs on a range of commodities, including precious metals like gold and silver, and agricultural commodities like cocoa and cotton. Trading commodities allows clients to diversify their portfolios and hedge against inflation.

Accounts

Demo Account

HYCM's demo accounts are a great way to practice trading without risking real money. They are unlimited, meaning you can use them for as long as you wish. With $50,000 in virtual money and no documentation required, you can explore the platform and test your trading strategies in a risk-free environment. But the virtual money will be active for 14 days, after which you can reset the account if needed.

Account Types Comparison

HYCM offers three distinct account types—Fixed, Classic, and Raw—each tailored to meet the diverse needs and preferences of traders.

Despite their differences, these accounts share several common features. Firstly, they all require a minimum deposit of $20, making them accessible to traders with varying levels of capital. Additionally, all three accounts offer a maximum leverage of 1:500, providing traders with the ability to amplify their trading positions. Furthermore, HYCM provides a swap-free option for each account type, ensuring compliance with Islamic principles.

| Account Type | Min Deposit | Max Leverage | Spread | Expert Advisor | Swap Free | Trading Platforms |

| Fixed | $20 | 1:500 | From 1.5 pips (fixed) | No | Yes | HYCM Trader, MT4, MT5 |

| Classic | $20 | 1:500 | From 1.2 pips (variable) | Yes | Yes | MT4, MT5 |

| Raw | $20 | 1:500 | From 0.1 pips (variable) | Yes | Yes | MT4, MT5 |

Fixed Account: It stands out for its fixed spread, starting from 1.5 pips. This feature provides traders with predictability in their trading costs, which is beneficial for those who prefer stable trading conditions. However, the Fixed Account does not support the use of Expert Advisors, which is a drawback for traders who rely on automated trading strategies.

Classic Account: It offers variable spreads starting from 1.2 pips, allowing traders to benefit from potentially tighter spreads during certain market conditions. Moreover, this account type supports the use of Expert Advisors, making it suitable for traders who employ automated trading strategies to execute their trades.

Raw Account: It is characterized by its ultra-low spreads, starting from 0.1 pips. This account type is ideal for traders who prioritize minimizing their trading costs and seek competitive pricing. Like the Classic Account, the Raw Account also supports the use of Expert Advisors, providing traders with flexibility in their trading strategies.

How to Open an Account?

The procedure to open a live account is very straightforward. Simply follow the 3 basic steps as the account opening procedure below.

Step 1: Register

Visit the official website of HYCM, then click the “Get Started” or “Open An Account” button to start your registering process. Then fill up the necessary information, including your first name, last name, Emai, and phone number.

And you also need to choose your account type. If you are not sure which type to choose, you can answer the questions on the official website to figure it out.

Step 2: Deposit funds

Fund your account via your chosen method. You can pay for it through Debit/Credit card (Visa or Mastercard), Skrill, Neteller, China Union Pay, Interac or Wire Transfer.

Step 3: Trade

Now you have created an account, and you can start your trade on it.

Spreads & Commissions

HYCM offers different spreads for various account types and market instruments. And a commission of $0 - $5 per round will be charged to the Raw account. Here we list the spreads for certain market instruments. To get full information, you can visit the website: https://hycm.com/en/products.

Forex Pairs: The spreads for forex pairs vary depending on the account type and the specific currency pair. For example, the AUD/CAD pair has a spread of 3 pips for the Fixed account, a spread of 2.2 pips for the Classic account and 1.2 pips with an additional commission of $4 per round for the Raw account.

| Instruments | Min. Spread (Fixed) | Min. Spread (Classic) | Min. Spread (Raw) |

| AUDCAD | 3 pips | 2.2 pips | 1.2 pips + $4 per round |

| AUDCHF | 3 pips | 2.2 pips | 1.2 pips + $4 per round |

| AUDJPY | 2.5 pips | 1.8 pips | 0.7 pips + $4 per round |

| AUDNOK | 50 pips | 31 pips | 21.0 pips + $4 per round |

Stock CFDs: For stock CFDs, the spreads are typically higher than for forex pairs. For example, the minimum spread for 3M Company is 28 pips for the Fixed account and 27 pips for both Classic account and Raw account.

| Instruments | Min. Spread (Fixed) | Min. Spread (Classic) | Min. Spread (Raw) | Platforms |

| 3M Company | 28 pips | 27 pips | 27 pips | MT5 |

| AIG | 12 pips | 9 pips | 9 pips | MT5 |

| AT&T | 9 pips | 8 pips | 8 pips | MT5 |

| Activision | 16 pips | 14 pips | 14 pips | MT5 |

Index CFDs: Index CFDs also have varying spreads. For example, the minimum spread for the AUS200 index is 3.4 pips for the Raw account, 3.9 pips for the Classic account and 7 pips for the Fixed account.

| Instruments | Min. Spread (Fixed) | Min. Spread (Classic) | Min. Spread (Raw) |

| AUS200 | 7 pips | 3.9 pips | 3.4 pips |

| China 300 Index CFD | 3 pips | N/A | N/A |

| China A50 Index CFD | 10 pips | 5 pips | 5 pips |

| China H-Shares Index CFD | 10 pips | 7 pips | 7 pips |

Cryptocurrency CFDs: The spreads for cryptocurrency CFDs are also competitive. For example, the minimum spread for BTCUSD is 90 pips for the Raw account, while the minimum spread for SOLUSD is 0.9 pips for the Raw account,

| Instruments | Min. Spread (Fixed) | Min. Spread (Classic) | Min. Spread (Raw) |

| BTCUSD | 100 pips | 90 pips | 90 pips |

| SOLUSD | 1 pips | 0.9 pips | 0.9 pips |

| ETHUSD | 10 pips | 9 pips | 9 pips |

| LTCUSD | 0.35 pips | 0.32 pips | 0.32 pips |

Commodity CFDs: The spreads for commodity CFDs can also vary. For example, the Gold CFD has a minimum spread of 4 pips for both the Raw account and the Classic account, while the minimum spread for Fixed account is 6 pips.

| Instruments | Min. Spread (Fixed) | Min. Spread (Classic) | Min. Spread (Raw) |

| BRENT CFD | 6 pips | 4 pips | 4 pips |

| COCOA CFD | 5 pips | 4 pips | 4 pips |

| COFFEE CFD | 30 pips | 25 pips | 25 pips |

| COPPER CFD | 70 pips | 60 pips | 60 pips |

Trading Platforms

HYCM offers its clients access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as its proprietary HYCM Trader platform.

MetaTrader 4

MT4 is the most widely used electronic trading platform and has been adopted as the financial market standard thanks to its cutting-edge technology. The platform offers many opportunities to traders of all skill levels, together with advanced technical analysis, flexible trading systems and Expert Advisors, as well as mobile trading applications.

MetaTrader 5

MT5 builds on the success of MT4 and offers additional features and improvements. MT5 is a powerful multi-functional, multi-asset platform featuring advanced technical analysis, fundamental analysis, flexible trading systems and compatibility with automated trading applications (trading robots, Expert Advisors).

HYCM Trader

HYCM Trader is HYCM's proprietary trading platform, designed to offer a user-friendly interface and seamless trading experience. It provides access to a wide range of trading instruments, real-time market data, and advanced charting tools. HYCM Trader is a mobile App available on both Android and iOS, but it can not be used on the desktop.

Trading Tools

HYCM offers a variety of tools to enhance your trading experience, including calculators, an Economic Calendar, and access to services like Trading Central, Seasonax, and Financial Source.

Seasonax provides insights into seasonal investment opportunities for over 20,000 stocks, commodities, indices, and currencies, helping you identify potential trends and make informed trading decisions.

Trading Central offers free access to forex trading signals, indicators, and risk management tools, giving you valuable insights and strategies to improve your trading performance.

Financial Source allows you to track market-moving events in real-time, helping you stay informed about what's happening in the markets and the reasons behind the movements.

Economic Calendar helps you stay up to date with important events and releases that can impact the forex, stock, and commodity markets, allowing you to plan your trades accordingly.

Deposits & Withdrawals

HYCM offers a diverse range of payment methods, including Bank Wire, Visa and MasterCard, Neteller, Skrill, Crypto, PerfectMoney, AstroPay, WebMoney, PayTrust, Fasapay, Zotapay, and UPI, to facilitate deposits and withdrawals, ensuring convenience and accessibility for its clients.

Deposits

In terms of deposits, all payment methods require a minimum deposit of $20. And all deposits are processed with no fees.

Bank Wire transfers support currencies such as USD, EUR, and GBP. However, they can take 1 to 7 working days to process.

Supporting USD, EUR, and GBP, Visa/Mastercard deposits are processed in up to 1 hour.

E-wallet options like Neteller and Skrill support USD and EUR. They offer quick processing times of up to 1 hour.

Crypto deposits are processed within up to 3 hours.

PerfectMoney, AstroPay, WebMoney, PayTrust, Fasapay, Zotapay, and UPI, only supporting USD, but offer quick processing times up to 1 hour.

Withdrawls

The minimum withdrawal amount varies depending on the method ($20 for e-wallets to $300 for bank transfers). Most methods support USD, but other currencies may be available with varying conversion processes. While most methods are fee-free at HYCM, be aware of potential fees from your bank or provider.

For traditional options, Bank Wire Transfer is a secure choice for larger withdrawals but takes the longest (1-4 working days). While HYCM doesn't charge fees, your bank may have charges. Visa/Mastercard is convenient for smaller withdrawals, but processing times range from 1-7 working days. HYCM doesn't charge fees, but you may incur foreign transaction fees and interest charges.

E-Wallets like Neteller, Skrill, and Perfect Money offer faster processing within 24 hours and fee-free withdrawals from HYCM.

For cryptocurrencies, you can withdraw within 24 hours using various cryptocurrencies for a fast and decentralized option.

Education Resources

HYCM offers a comprehensive educational platform covering various aspects of trading in forex, stocks, indices, and commodities. You can access many beneficial articles on HYCM. These educational resources are designed to provide traders with the knowledge and skills necessary to make informed trading decisions and navigate the financial markets effectively.

For forex trading, they provide insights into learning about forex, Bitcoin trading, examples of forex trades, and the risks associated with forex trading.

When it comes to commodities, HYCM educates traders on the benefits of investing in commodities, including precious metals, and how commodities can help reduce risk in a portfolio.

For stock trading, HYCM offers resources on learning stock trading, examples of CFD stock trades, and how to choose the best stocks to trade, along with an explanation of the risks involved.

In indices trading, HYCM explains the advantages of trading indices, provides examples of CFD indices trades, and helps traders understand the main market indices and their weighting.

Additionally, HYCM covers general trading questions such as volatility, CFDs, upticks, slippage, support levels, and short positions.

Regional Restrictions

HYCM has restrictions on accepting clients from certain countries and nationalities. They are unable to accept clients from countries including Afghanistan, Albania, Barbados, Belgium, Burkina Faso, Cambodia, Canada, Cayman Islands, Cyprus, Democratic Republic of Congo, France, Gibraltar, Haiti, Hong Kong, Jamaica, Mali, Mozambique, Myanmar, North Korea, Panama, Philippines, Portugal, Russian Federation, Senegal, South Sudan, Spain, Sudan, Syria, Tanzania, Uganda, USA, among others. Additionally, they cannot accept clients with nationalities from the USA, Hong Kong, North Korea, Sudan, Russian Federation, and Belarus.

Customer Services

HYCM provides a range of customer support options for its clients. You can reach them via telephone at +442088167812 or through email at support@hycm.com for general support, accounts@hycm.com for account-related inquiries, info@hycm.com for general information, and complaints@hycm.com for complaints.

Additionally, HYCM offers live chat support on their website for real-time assistance. They are also active on various social media platforms such as Telegram, Facebook, Twitter, LinkedIn, Instagram, YouTube, Crunchbase, and Discord, providing multiple channels for clients to connect with them and receive support.

HYCMs Group Awards

HYCM claims to has received 25+ awards over the years, recognizing its excellence in various categories within the forex trading industry. These include awards for Best Forex Broker, Best Trading Platform, and Best Customer Service. Some representative ones include Most Trusted Broker in 2023 in the UAE, Most Transparent Forex Broker in 2023, Best Forex Broker in 2022 in the Middle East and Best Multi-Regulated Forex & CFD Provider in 2022 in the UAE.

Conclusion

HYCM is a reputable and well-established broker with a long history in the financial markets. Regulated by multiple authorities, including FCA, CySEC, CIMA and DFSA, HYCM provides a secure and reliable trading environment for clients. With a wide range of trading instruments, account types, and trading platforms, HYCM caters to the diverse needs and preferences of traders.

We think HYCM is a good choice to you. You can start with a demo account, which is a great way to practice trading and familiarize yourself with the platforms before using real money. Additionally, it's important to choose a suitable account type that aligns with your trading preferences and goals.

FAQs

Q: Is HYCM regulated?

A: Yes, HYCM is regulated by FCA, CySEC, CIMA, and DFSA.

Q: What trading platforms does HYCM offer?

A: MT4, MT5, as well as its proprietary HYCM Trader platform.

Q: What is the minimum deposit required to open an account with HYCM?

A: $20.

Q: Does HYCM offer a demo account?

A: Yes.

Q: What payment methods does HYCM accept?

A: HYCM accepts a variety of payment methods, including Bank Wire, Visa and MasterCard, Neteller, Skrill, Crypto, PerfectMoney, AstroPay, WebMoney, PayTrust, Fasapay, Zotapay, and UPI.

Q: Can residents of all countries open an account with HYCM?

A: No, it is unavailable to clients from Afghanistan, Albania, Barbados, Belgium, Burkina Faso, Cambodia, Canada, Cayman Islands, Cyprus, Democratic Republic of Congo, France, Gibraltar, Haiti, Hong Kong, Jamaica, Mali, Mozambique, Myanmar, North Korea, Panama, Philippines, Portugal, Russian Federation, Senegal, South Sudan, Spain, Sudan, Syria, Tanzania, Uganda, USA, and clients with nationalities from the USA, Hong Kong, North Korea, Sudan, Russian Federation, and Belarus.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade